Refund allocations are used to balance overpaid orders. This is done by applying a negative allocation amount to the order.

This amount is equal and opposite of the overpayment amount, and is applied in the following order:

1.Donations or Gifts.

2.Requests plus any service charges and taxes.

3.Order charges plus any miscellaneous items, delivery charges, bundle charges or taxes.

4.Admissions plus any associated taxes and service charges.

5.Gift Certificates or Gift Cards.

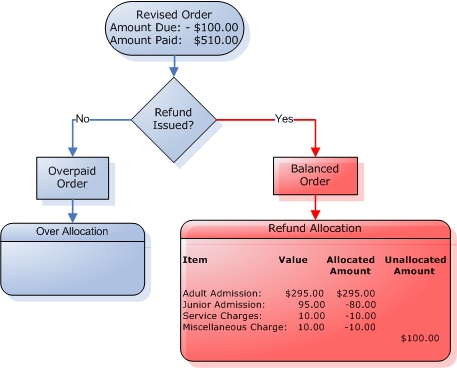

Suppose that after making a full payment to an existing $510.00 order, a customer changed a Senior Admission to a Junior Admission. This resulted in an overpaid balance of $100.00.

The order was modified as follows:

Order Item |

Net Value |

Service Charges |

Grand Total |

Adult Admission |

$295.00 |

$5.00 |

$300.00 |

Senior Admission Junior Admission |

$195.00 $95.00 |

$5.00 $5.00 |

$200.00 $100.00 |

Miscellaneous Charge |

|

$10.00 |

$10.00 |

|

$490.00 $390.00 |

$20.00 |

$510.00 $410.00 |

Upon revising the order, the order is balanced by issuing the customer a refund of $100.00.

This results in the following transactions:

Transaction ID |

Transaction Type |

Debit |

Credit |

1 |

Order Creation |

$510.00 |

|

2 |

Customer Payment |

|

$510.00 |

3 |

Change Admission |

- $100.00 |

|

4 |

Negative Adjustment |

|

-$100.00 |

This refund is applied as follows: